IRS 1095-C Form (Employer-Provided Coverage Insurance) 2024-2025

Show details

Hide details

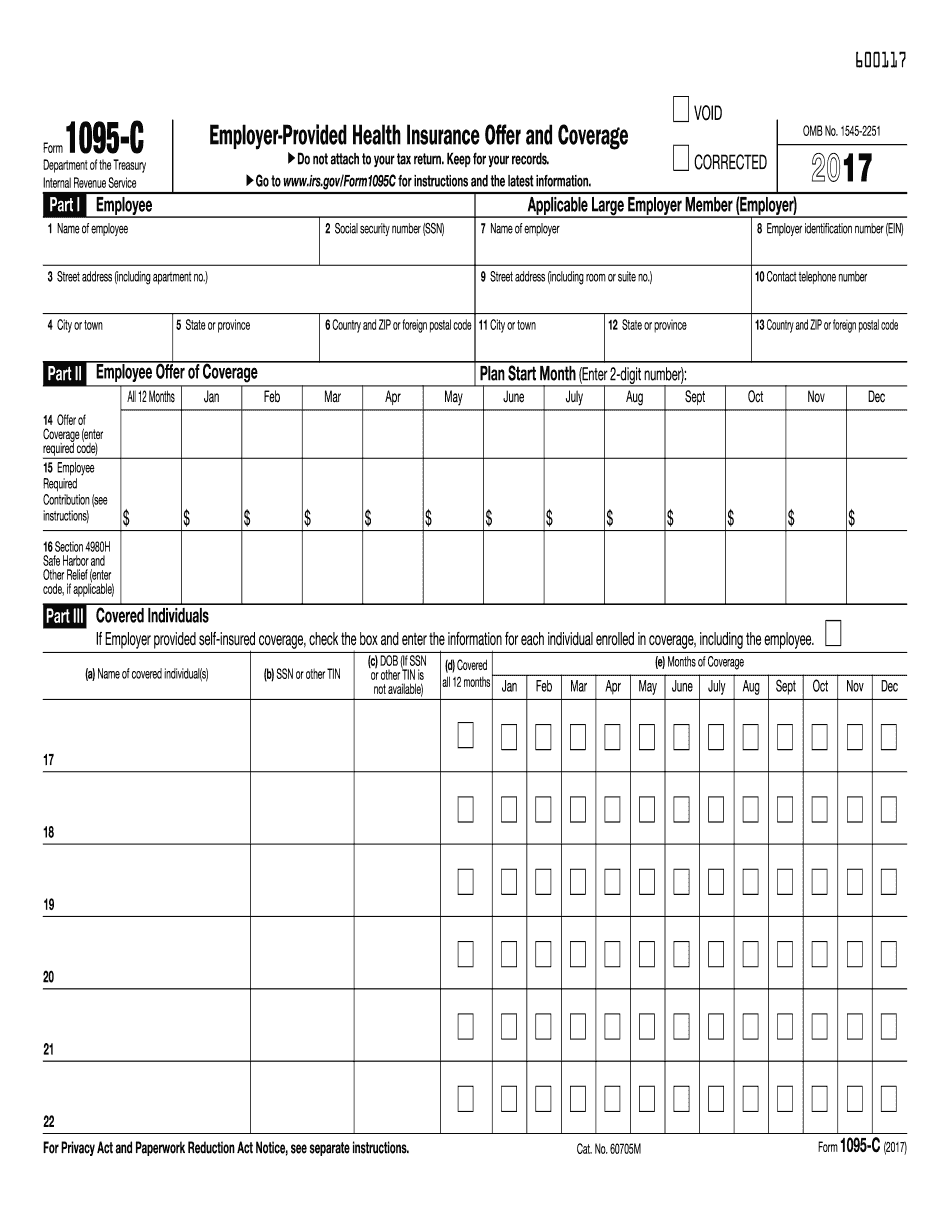

Part III if they request it for their records. Covered Individuals Lines 17 22 You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared responsibility provision in the Affordable Care Act. Form 1095-C Part II includes information about the coverage if any your employer offered to you and your spouse and and wish to claim the premium tax credit this information will assist you in determining whether you are eligible. Similarly if ...

4.5 satisfied · 46 votes

form-1095c.com is not affiliated with IRS

Filling out Form 1095-C online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 1095-C

Every person must report on their finances on time during tax season, providing information the IRS requires as accurately as possible. If you need to Form 1095-C, our trustworthy and intuitive service is here to help.

Follow the steps below to Form 1095-C promptly and accurately:

- 01Import our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Check out the IRSs official instructions (if available) for your form fill-out and attentively provide all information required in their appropriate fields.

- 03Complete your template utilizing the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to stress particular details and Erase if something is not relevant anymore.

- 06Click the page arrangements key on the left to rotate or delete unnecessary file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your tax statement from our editor or choose Mail by USPS to request postal report delivery.

Opt for the simplest way to Form 1095-C and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is irs govform1095a?

Applicable Large Employers hiring over 50 employees have to use 1095 C Form. This document should contain information for employer-provided Health Insurance Offer and Coverage.

Every full-time employee has to meet certain health standards. For its part, every ALE should pay, record and report insurance expenses to the Internal Revenue Service. This procedure must be held on a yearly basis.

The IRS requires the report to ensure that worker insurance costs have been covered properly. It is necessary to prepare one example for each employee.

Choose online templates to organize your workflow more conveniently. Electronic versions of 1095 C Form are accepted by March 21 when paper samples only by the end of February.

To prepare the document correctly, read carefully all the field labels. Pr only truthful and verified information.

Include the following details:

- 01ALE information i.e. name, address, EIN.

- 02Employee data (name, SSN, address, family members etc).

- 03Duration of the offer.

- 04Complete all the blank fields, add your signature and put the date.

Note that you may sign the form by typing, drawing or uploading your signature from any internet-connected device. Submit the file via email, fax or even sms.

You may print out the Form 1095-C and fill it out by hand. Then make two copies to submit to your local IRS agency and to the employee.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1095-C?

The tax form you received was a copy of Form 1095-C, which is a copy of Form 1055, Your Federal Income Tax for 2013, that may have been made by the Internal Revenue Service (the IRS) or made by the state or local government if you lived in a state with income tax. The Form 1055 is the federal income tax filing document, and it was issued to all taxpayers to aid in calculating and reporting your federal income tax. The Form 1095-C has many more sections and sub-sections than the Form 1055; therefore, you will need to review each section and sub-section of the 1095-C to determine whether the tax information on that form applies in your case. Note that all information from Form 1095-C is subject to change, which could impact your tax filing.

How does filing Form 1095-C affect my 2014 tax return? For your 2014 U.S. income tax return filing deadline, the return of the Form 1095-C will be due between January 31 and March 31 of the given year; therefore, you must file by the March 31 return deadline to avoid penalties. If you are not sure where to file your 2014 tax return, you can use the IRS' file site. You can fill out and file your return online or on paper. Once you have completed and submitted Form 1095-C, the IRS will prepare your 2014 tax return for submission. The IRS' site will tell you the deadline for your return (i.e., the March 31 return deadline) and will provide you with the link to download the IRS' file software.

What are the penalties that could be assessed if I file Form 1095-C without a valid excuse? You may be liable for additional penalties if you have: filed a return without a valid excuse. Your U.S. income tax return filing deadline is the date specified on your Form 1095-C, but you reported your income from your business, hobby, business interests, or income on your own personal account instead of on the business, hobby, or business interests lines of your Form 1040. This can only happen if you had a valid, excusable, nonfiling reason for failing to submit Form 1040 by the due date for the IRS to prepare it. If you are responsible for withholding or remitting the tax, you may have to pay the additional penalties due.

Who should complete Form 1095-C?

The answers to that question depend on the situation. Form 1095-C can be completed by: Corporations.

Individuals

Educational institutions that prepare Form 1095-B

Employers

Self-employed (other than corporations and educational institutions)

For more info see my post on the tax implications of owning a home.

Form 1095-A — Tax due for 2017

I have discussed the information you have to fill out in Part I, and now it is time to talk about the forms:

Form 1095-A

Form 1095-B

Form 1095-C

The Form 1095-A is an information return and contains information which is available in the IRS website (). There is no need to visit your tax office. The form simply lists your income, deductions, tax credits and other relevant information. If any information is missing or incorrect, you should consult with your tax preparer or accountant before completing this form. If you qualify for one or more of the exemptions, you should also report the information you need in Part II.

The information from Form 1095-A is available in the following sections. You will also find sections for the various filing types and for the different tax tables. I refer to the sections under “How Do I Print Out Form 1095-A?”

What is Required to be Included on Form 1095-A?

There are only two mandatory sections on Form 1095-A. One section is “Additional Information”, and the second is a section for each state and U.S. Territory.

The only information that is “mandatory” is the information on your federal income tax return. This includes the total amount of your federal income tax liability and the amount that you paid and that you expect to pay.

The first section of Form 1095-A requires the income tax return number to be entered on the form, the federal income tax return number.

After this field is checked, enter whichever information you did not include on your tax return.

When do I need to complete Form 1095-C?

If you paid 200,000 or more to a covered entity for qualified domestic service performed by your employee, you can use Form 1095-C to report the tax you withheld from your employee's wages while performing qualified domestic service. If you paid 50,000 or more to a covered entity for qualified medical services performed by your employee, you can use Form 1095-C to report the tax you withheld from your employee's wages while performing qualified medical services. If you paid your employee less than wages due, you must still report any taxes withheld on your Form 1040 or Form 1041. If you do not get a Form 1095-C in the mail from a covered entity in the time period you need, you are not required to complete the form. See later.

What are qualified domestic service and qualified medical services? Generally, a qualified domestic service is performed for work performed at home and is necessary to qualify for a family exemption. A qualified medical service, on the other hand, is necessary to treat or manage the effects of a covered illness or disability. The term “qualified medical service” does not include any medical services you would pay for at a medical office, hospital or other health care facility. You can use a Schedule SE to figure the tax you paid on qualified domestic service. The amount you report should be the total wage and salary due from your employee, as shown on your Form W-2, to the employer that provides your employee's qualified domestic service. Generally, you must report the tax withheld under the following scenarios: You pay your employee more than wages your employee would earn if you did not pay the wages. For example, if you paid your employee 300,000 for a qualified domestic service and he or she actually earned only 200,000, you must withhold 150,000 of the 300,000 your employee earned as income tax under the FTA exclusion and 25,000 of the 200,000 he or she earned as wages.

You pay your employee less than wages your employee would earn if he or she did not perform your employee's service. Generally, if your employee performed the service and earned less than you paid for it, no tax is required from your employee except for the tax you would pay if you did not have to pay the employee the wages withheld.

Can I create my own Form 1095-C?

Yes. A Form 1095-C can be created in connection with any taxpayer activity and not just for the year in which the taxpayer's income or loss is assessed or received and any subsequent years when tax payments are due.

Q: Could I use Form 1065-A for the reporting year in which I filed my return?

Unfortunately, the IRS would not be able to accept Form 1065-A for any reporting purposes.

Q: What if I do not itemize my deductions on Schedule A?

You have the full option to use Form 1065-A to report on your personal income tax returns only income that is subject to tax withholding by the IRS.

You can also use Form 1065-A to report on your personal income tax returns only deductions that are subject to tax withholding by the IRS.

What should I do with Form 1095-C when it’s complete?

Complete a separate 1095-C-EZ for each employer or entity on Form 1095-C submitted by you. You aren't required to complete Form 1095-C when you file your W-2s and 1099s.

What should I do with Form 1095-C-EZ when it's incomplete?

Contact your IRS provider or contact the IRS at (TTY:). If you did not complete an employer identification number on the Form 1095-C, you may need a different form, for example, Form W-8ECI. If you use a checkbox to indicate whether the information you provided on Form 1095-C is false, you must either attach a false statement on the Form 1095-C or send the false statement with the IRS' new refund checks.

Is Form 1099-MISC included on the Schedule C line of Form 1095-C for individuals?

No, the Form 1099-MISC only includes information that is required on Schedule C. However, you must include the Form 1099-MISC when you prepare Form 1099-MISC for the reporting period for which it is required. To receive Form 1099-MISC for your reporting period, complete Form 1099-S, and enter the information in the following columns:

Date

Business

The dollar amounts in the brackets on Form 1099-MISC are for the reporting period for which they are applicable.

The filing status of the filer is not required to be reported.

You must enter the Form 1099-MISC amount by the specified deadline. To determine the specified deadline, enter the date on the last page of Form 1099-MISC.

Form 1099-MISC must be filed by the last day of your period that is included on the form.

For example, if your reporting period is April 15, you must file on or before June 15. You must include Form 1099-MISC with each Form 1099-MISC receipt received.

If you use Form 1099-MISC to obtain refunds, you do not have to include an accompanying Form 1099-MISC.

How do I get my Form 1095-C?

You must submit a completed 1095-C form to the IRS each year on or before your tax-filing deadline.

What documents do I need to attach to my Form 1095-C?

For the most part, all the documents that pertain to your tax return in a timely manner will be valid for use as substitute forms. There are, however, some exemptions that must be listed with each document (for Example: Social Security Numbers and Taxpayer Identification Numbers must be included on your Form 1095-C). For example, certain information that is required to be included on Form 1040NR is not allowed to be submitted.

How to Complete Your Form 1095-C

The instructions for Form 1095-C list all the information required to be filled out for each and every individual in the family. This list can be found by following the instructions for Line 21 of Form 1095-C. Once the information about the tax year, the household, any tax credits and the credits you applied is complete on the form, it cannot be amended.

How to Save Your New Year's Tax Return After You've Received Form 1095-C.

You can save your completed form 1095-C once you complete and submit it. To do this, visit Metal and select File 1040NR. In the File 1040NR portion of Metal, select the Form 1095-C that you just completed.

The IRS will provide you with a form that you can use to submit a duplicate of your 1099-MISC for the current tax year.

What are the different types of Form 1095-C?

Form 1095-C reports are the primary means by which the IRS collects information from employers and employees regarding employment income and deductions from employment. The Form 1095-C is most commonly received by employment-related employers or employees and is completed by employers or employment-related employees and employers of all employees. For example, for a tax year beginning on or after January 1, 2019, the Form 1095-C will be received by all employers in the United States who are required to file Form 1040, U.S. Individual Income Tax Return. This includes the majority of companies and for-profit organizations, as well as employees and self-employed owners.

Generally, the Form 1095-C reports information on:

Employees

Employer identification numbers

Nonemployee owners (defined below)

Tax on nonemployee compensation

Business income

Other income

Deductions and credits

Employee identification numbers

The IRS uses employee identification numbers (Wins) to identify each employee. An employee identification number is a unique number issued by or assigned to the employer that is used to identify an employee. For example, if you are an employer, you would have a legal duty to report the information on Form 1095-C to the IRS. If you are an employee, you can report the information using Form 5329-EZ, Employee's Withholding Allowance Return, to the IRS.

Nonemployee owners (News) have their earnings and employment income reported separately on Form 1095-C. The IRS has established four News: one is the employer, the second is the employee, the third is the employee's spouse, and the fourth is the spouse's spouse.

If the employer is an individual, the Form 1095-C should include the name, address, social security number (SSN), employment earnings, and employment income. It should also include the employer identification number (EIN), if the employer is reporting information to the IRS under the self-employment reporting requirements of section 479A of the Internal Revenue Code.

For certain employment-related employers, the Form 1095-C should include information that indicates whether the pay period was part of a tax year.

How many people fill out Form 1095-C each year?

Each calendar year, the IRS publishes data about the number of Form 1095-C filers, including income, tax withheld from wages, nonpayment of income taxes by other taxpayers, and certain deductions which are not reported to the IRS.

The data on Form 1095-C are published on the IRS website,, which includes both tables and charts on the number of Form 1095-C filers since 1982.

What is Form 1095-C?

The current version of Form 1095-C is 1.35 MB in file size with a 3 MB image file, and it can be printed, e-mailed, or saved to a CD-ROM.

Form 1095-C is a statement reporting the income of the taxpayer for a calendar year or fiscal return. It includes both individual and married filers.

It includes the following information: the taxpayer's name;

the filing status (I, II, III, or IV);

the filing status of spouse(s);

the filing status of dependents;

in the case of married filing separately, the filing status of each spouse;

the gross income of the taxpayer as reported by employer and the Social Security number of the taxpayer's employer;

the gross income of the taxpayer for the calendar year or year-end; and

The number of dependents the taxpayer claims as dependents.

The Form 1095-C may also include information from Form 1096-A, Payment of Federal Individual Income Taxes and Self-Employment Tax, or Form 1096-A2, Other Federal Tax Return.

What are the benefits?

In addition to the information on Form 1095-C with the income information reported, the Form 1095-C also may include information from Form 3115-EZ, Claim for Wages Paid by the Unemployed, the Social Insurance Number (SIN), and any other information requested by IRS.

What is the format of the Form 1095-C?

Firm or individual.

Printed or emailed.

Firm or individual with or without a company type designation.

Firm or individual with or without a business type designation.

Form 1095-C can be filled in a single format, or in a separate format for each filing type.

Is there a due date for Form 1095-C?

Yes. The due date is March 31. You may send Form 1095-C by mail or email. You may use the E-Z Deduction Calculator to determine whether to mail or email a return to the IRS.

Does my filing status change during my leave?

Yes. If you change your tax withholding in order to avoid tax liability, you may need to amend your Form 1095-C with a new or updated tax withholding.

Can I have a refund if I have a Form 1095-C for previous years?

Yes. If you paid estimated tax in a previous year, and you did not receive a Form 1095-C for that year, but can show reasonable cause that you did not receive a Form 1095-C, you may apply for a refund. To apply, you will need to attach the applicable evidence.

A refund for any taxes paid can generally only be applied within 45 days of the date you paid estimated taxes.

Your refund may be claimed the same year it is received if you do not apply for a refund before March 31. However, there is no guarantee when you will receive a tax return.

I used Form 1095-C to figure my tax. What should I do with the amount I paid?

File a Form 1120S, Request for Payment of Taxes Not Collectible or Refunded (WITHDRAWAL OF REFUNDABLE TAXES). It will provide you with your refund. It must be filed by the return due date, not the date that the Form 1095-C was issued.

Back to Top

Form 1100-E for Child Tax Credit

(See Publication 525 for other forms).

Note: The current version of Tax Form 1100 includes a statement indicating that the form is a request for payment of taxes not collectible or refunded (WITHDRAWAL OF REFUNDABLE TAXES). The current version of Tax Form 1100 also includes the instructions for completing both the Form 1110 and the Form 1100-E.

What is Form 1100?

Form 1100 is a request for payment of taxes not collectible or refunded (WITHDRAWAL OF REFUNDABLE TAXES).

What does the Form 1100 do?

Form 1100 requests that the IRS pay you taxes not collectible or refunded. The amount requested must not be deducted or paid directly to the taxpayer.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here