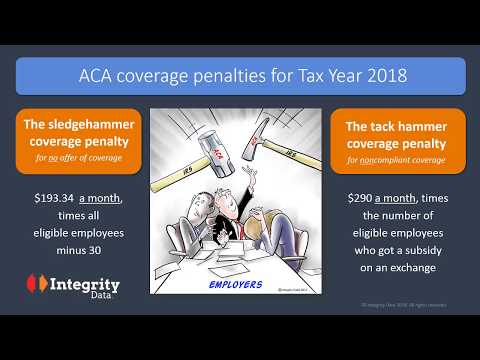

If your organization meets the ACA classification for an applicable large employer, you face serious financial consequences if you do not comply with both the coverage mandate and the related reporting obligations of the Affordable Care Act. There is a monthly risk of coverage penalties and a yearly risk of filing penalties. Each penalty can add up very quickly, and none of them can be deducted as business expenses. First, we will look at the coverage penalties, which have come to be known by the names one employee benefits lawyer gave them when they first came out: the sledgehammer and the tack hammer. Each of these penalties is triggered when an employee who has not been offered a health plan or a compliant health plan gets subsidized coverage on an exchange. It is important to note that the numbers you see for these monthly assessments are for tax year 2018. These penalty amounts go up every year. Let's learn more about these penalties. An employer who offers no health plan is at risk of the ACA sledgehammer penalty. The trigger for this penalty is the IRS finding, through its data crunching, that an employee who is eligible for an employer-sponsored plan did not get an offer of health insurance from his or her employer. Instead, they sought coverage on an exchange and got a subsidy or tax credit for that coverage. Here's how the multiplier works for the sledgehammer penalty: If you have an employee that was eligible for coverage in a certain month, and your 1095-c reporting for that tax year shows that no offer of coverage was made to that employee in that month, then the penalty you're facing is $193.34 multiplied by all your ACA defined full-time employees. This calculation is for that month and all months afterward in that tax...

Award-winning PDF software

1095 C code for employees waiving coverage Form: What You Should Know

Form 1095-C, Offer of Coverage and Form 1095-C, Line 14, Section 4980H Safe Harbor and Other Relief. If you received your forms from the IRS within the last three months then the IRS is processing these forms and your Forms 1095-C may be available sooner. Please let us know if you have any additional questions. Note: Employees that are in a temporary or seasonal employment situation during the tax year would only need to fill Form 1095-C, Offer of Coverage, and Form 1095-C, Line 14, Section 4980H Safe harbor and Other Relief after March 31, 2018. If you completed a 1093-B and are enrolled in your health plan beginning January 1st, 2018, then you have the option to make a Form 1095-C, Offer of Coverage, prior to October 18, 2018. If you filled out this form in 2025 and have not received your 1095-C yet, then you will probably receive it by March 2, 2019. If you filled out the forms earlier than 2025 but did not receive your 1095-C you should contact your insurance company and request it as soon now as possible, because it could be delayed until March. Your 1093 and 1096 forms should be ready by March or April, depending on your insurer. What are the possible reasons you may receive a 1095-C? Explanation of Potential 1095-C Reasons — The Taxpayer Advocate Service (TAS) explained the following potential reasons for not paying for coverage until April 15, 2018: Not all 1095-Cs are used for same purpose If you completed the form in 2025 and your health plan was not activated until January 1st of the next year in 2016, all forms that were provided to you on or after January 1st, 2017, are considered to be Forms 1095-C for any plan year after 2025 (and prior) Any Form 1095-C you receive will have the same code that was previously used. If your code was changed, do not be discouraged if the old type of code shows up on your 1095-C. In fact, this is an indication that you already did something. For example, in some cases, the code in your 1095-C may have been changed on January 6, 2017. That's why we encourage you to file your taxes on the old forms, not on the new ones.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1095-C, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1095-C online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1095-C by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1095-C from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1095 C code for employees waiving coverage